The Future of Autonomous Trading Intelligence

Create, simulate, and deploy ultra-smart trading agents that adapt in real-time using cutting-edge AI models.

Leverage the power of Autonomous

AI Agents

Train, test, and launch intelligent agents that detect opportunities, execute trades, and refine themselves automatically.

Smart Agent Toolkit

AI Modules & Trading Intelligence

Fine-tuned for precision entry & exit

Real-Time Webhook Integrations

Trigger Your Agents Across Any Platform

AutoFlow integrates seamlessly with major exchanges, DeFi protocols, and trading platforms. Deploy signals via webhooks in real-time.

TradingView

Discord

Telegram

Email, Push & Custom APIs

Backtesting Engine Built for Scale

Test strategies at high granularity with accurate market replication.

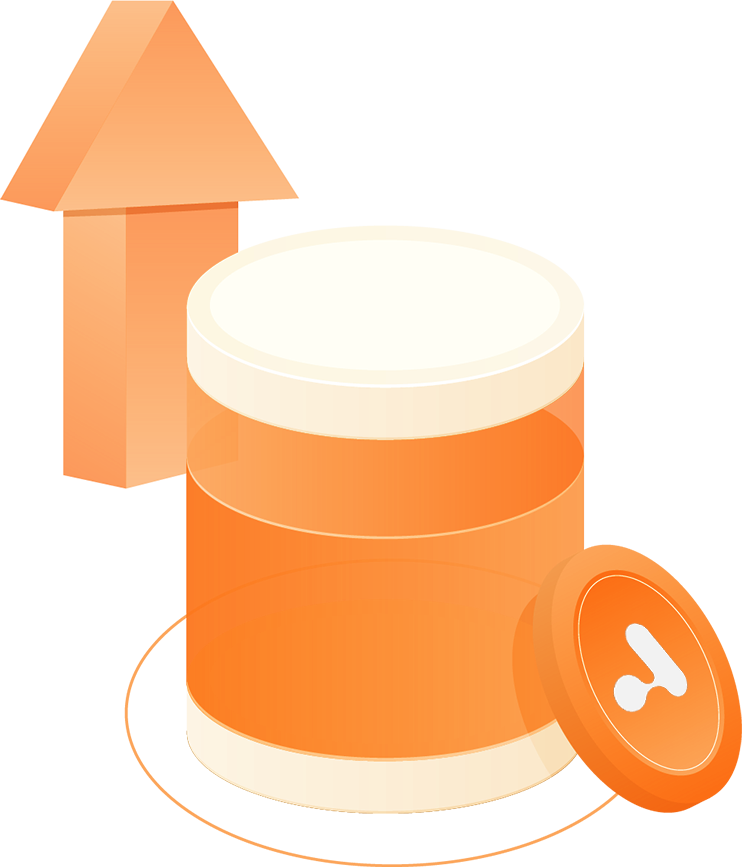

Tokenomics

Ticker: $AF

Total Supply: 1,000,000,000

No Tax

Unlock advanced strategy modules

Increase the execution frequency and concurrency of AI agents

Reduce platform fees

Participate in strategy governance and community proposals

Used for staking to obtain rewards

$AF is the core fuel of the AutoFlow ecosystem

FAQ

AutoFlow AI is an AI-powered automated trading platform that enables users to create, train, and deploy intelligent trading agents with a no-code interface. It supports multiple chains and platforms, designed for both beginners and professional traders.

You can configure webhook URLs inside AutoFlow and link them to your signal sources (e.g., TradingView). Once your signal conditions are met, the webhook automatically sends instructions to your trading agent for real-time execution.

Yes. You can modify parameters on existing strategy templates or build your own trading agents from scratch and save them as personal templates.

AutoFlow currently supports Binance, Bybit, OKX, Uniswap, PancakeSwap, GMX, 1inch, and many more centralized and decentralized platforms—with more being added continuously.

Yes. You can create strategies for both spot and futures/derivatives trading. Each type comes with its own set of parameters and risk management tools.

Not at all. AutoFlow provides a visual strategy builder and drag-and-drop logic editor, making it accessible for users with no technical background.

The AI Optimizer automatically adjusts your strategy parameters based on historical market data, aiming to maximize long-term returns and minimize risk.

Yes. AutoFlow uses high-precision tick-level historical data and real orderbook replay to simulate authentic trading conditions.

You can set take-profit/stop-loss levels, limit max open orders, and configure position sizing. Additionally, AI agents can auto-detect abnormal volatility and respond accordingly.

Absolutely. We support multiple DEXs and provide on-chain data feeds, wallet signing integration, and gas cost simulation.